property tax assistance program calgary

Apply for property tax assistance. Figures show the City of Calgary approved 3400 applications from residential and non-residential property owners through its tax assistance program up from 700 in 2014.

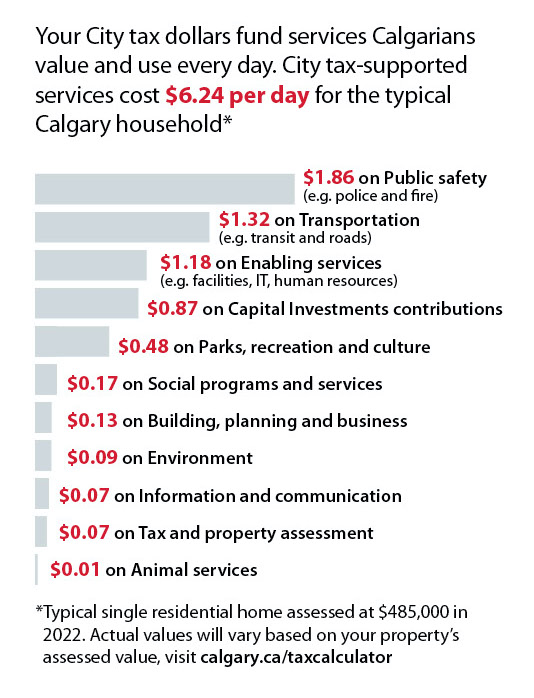

How Our Property Tax And Utility Charges Measures Up Nationally

Fair entry low income assistance.

. Have experienced an increase in property tax from the previous year. The City of Calgary Property Tax Assistance Program Property tax Offered to all low- income homeowners experiencing financial hardship. Waste Recycling Rebate No Cost Spay Neuter Program Seniors Services Home Maintenance 44month 75 per cent off.

Social programs and services. Once approved they also receive a 25 rebate on the Citys waste and recycling fees. Box 2100 Station M 8113 Calgary AB T2P 2M5 403-268-2489 calgaryca Advertisement references resources.

Current Program Fees Calgary Transit Low Income Monthly Pass adultyouth Recreation Fee Assistance Property Tax Assistance Program incl. If you are experiencing financial hardship you can apply for Property Tax Assistance Program The City of Calgary. Social programs and services.

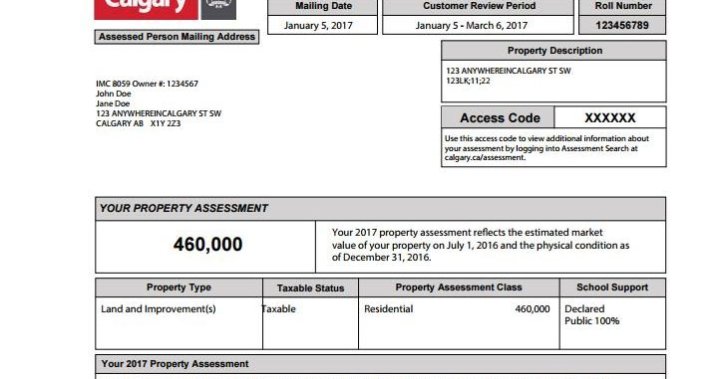

Fair entry low income assistance. 2016 Property Tax Bill Sean Chu. The Tax Instalment Payment Plan TIPP suspended.

Please contact Calgary Transit at 403-262-1000 for more information. The same subsidy value for each program as indicated in the following table. Fair entry low income assistance.

Taxes and property assessment. If you qualify Seniors Property Tax Deferral Program will pay your residential property taxes directly. If you are a residential property owner experiencing financial hardship you may be eligible for a credit on your property tax account through the council-approved 2005 Residential Property Tax Social Support Program.

Own the property for a minimum of. Social programs and services. Programs offered through fair entry include assistance with recreation fees calgary transit passes property tax assistance and the seniors home maintenance program.

Property Tax bills are mailed in May and due June 30 2022. Individuals and families that meet low income eligibility criteria. Eligible applicants receive a credit on the year-to- year increase on their property tax.

A creditgrant of the increase on the property tax for eligible low-income Calgarians. Application for tax instalment payment plan tipp contact. To be eligible for this program you must.

To ensure all Calgary property owners pay their fair share of municipal taxes The City conducts assessments each year that reflect the market value for property as Property Assessment Web properties as they arent a large number of overall properties but do comprise a significant proportion by assessed value- which is what affects property tax dollars. Even if you are not eligible for the Property Tax Assistance Program the City of Calgary may be able. Individual programs may have further eligibility criteria visit website for details.

Your payment is automatically withdrawn from your chequing. Meet the residency and income guidelines of the Fair Entry Program. Taxes and property assessment.

Apply now through Fair Entry and your one application can also get you access to additional subsidized programs and services. Senior citizens over 65 years of age are eligible for Property Tax Assistance for Seniors Program which offers rebates of tax increases based on 2004 tax. Property Tax Assistance Program The City of Calgary PO.

All groups and messages. Property Tax Assistance Program. 800 Macleod Trail SE Calgary Alberta T2G 2M3.

The City of Calgary is supporting citizens and businesses in response to the COVID-19 pandemic. For the 2021 tax year Council approved two municipal property tax relief measures to provide flexibility for property owners facing financial hardship. Senior citizens over 65 years of age are eligible for property tax assistance for seniors program which offers rebates of tax increases based on 2004 tax.

If you fulfill the program conditions you are eligible for tax rebate. The Seniors Property Tax Deferral Program allows eligible senior homeowners to voluntarily defer all or part of their residential property taxes including the education tax portion. Property and business taxes.

If you are a residential property owner experiencing financial hardship regardless of age you may be eligible for a creditgrant of the increase on your property tax account. Taxes and property assessment. Bylaws and public safety.

This is done through a low-interest home equity loan with the Government of Alberta. Web Tax Instalment Payment Plan BTIPP is a program that allows you to pay your Business Improvement Area BIA tax on a monthly basis instead of a single annual payment. Own no other City of Calgary residential property.

Bylaws and public safety. 204-986-3220 to be eligible for the tipp program your current year property tax account pad from myour financial institution is attached to this application. Own your own home and reside in your home.

311 or toll free 1-877-311-4974 вђ fax. Beginning in 2017 and through to 2020 Calgary City Council implemented a tax relief program known as the Non-Residential Phased Tax Program PTP to help mitigate the increase in non-residential property taxes. Bylaws and public safety.

The City of Calgary offers financial assistance to low-income homeowners who see an increase in their property tax. Property tax assistance program. Phased Tax Program.

Property Tax Assistance Program. Since its introduction the city of Calgary has spent more than 200 million on the PTP.

Commercial Equipment Loans Calgary Winnipeg Loan Construction Equipment Calgary

Everything You Need To Know About Equipment Financing Trucks Finance Loans Loan

Alberta Covid 19 Property Tax Updates Our Commercial Real Estate Services Altus Group

Handful Of Communities To See Calgary Property Tax Increase Livewire Calgary

Equipment Financing Alberta Semi Trucks Financial Services Trucks

A New Tool To Help You Track Rent Payments Rent Payment Helpful

Calgary Property Tax Assessments 2017 What You Need To Know Calgary Globalnews Ca

Property Tax Solutions Our Main Task To Help Property Owners Delinquent Property Tax Lampasa Property Tax Lampasas Co Tax Help Tax Preparation Property Tax

Why Homeowners Not Businesses Are Paying More And More Of The Property Taxes In Calgary Cbc News

How Our Property Tax And Utility Charges Measures Up Nationally

Property Tax Rates In Calgary And Edmonton Much Higher For Businesses Than Residents Fraser Institute

Property Tax Assessments Appeals In Calgary Our Commercial Real Estate Services Altus Group

Handful Of Communities To See Calgary Property Tax Increase Livewire Calgary

Why Homeowners Not Businesses Are Paying More And More Of The Property Taxes In Calgary Cbc News